IQ-EQ Fund Performance Snapshot

Equity markets rose by 3.2% during the fourth quarter as measured by the MSCI World Index (net), ending the period at the upper end of a 4% trading range and close to all-time highs. The index had reached those highs by the end of October and traded sideways for the rest of the quarter. A quarter percent cut in US interest rates in December – which was by no means a certainty earlier in the quarter – helped support equity markets. The gains took the full year 2025 return to 6.8% in euro terms.

October saw the start of the third-quarter earnings reporting season, which confirmed strong momentum in the earnings of technology-related companies. However, after a positive start to the quarter, the technology sector faded towards the end of the year as investors reconsidered the AI trade. Despite the pull-back, the sector retained its position as the largest contributor to equity returns in 2025, accounting for ca.38% of the total global equity return.

Healthcare shares, which have underperformed the market in recent years, were the standout performers during the fourth quarter. The sector got a welcome boost early in October as Pfizer reached an agreement with the US government on drug pricing and tariffs. Investors, who were booking some profits on technology shares during November and December, were enticed by the relatively attractive valuations available in the Health Care sector.

The Real Estate sector was the only group with a negative return for the quarter. The sector has been out of favour in recent years due to persistently high interest rates in the US and oversupply in certain sub-sectors, such as Healthcare and Self-Storage.

At IQ-EQ Fund Management, we focus on profitable businesses which generate persistent returns and have high levels of protection combined with competent management. We define these as quality businesses, and we expect them to perform irrespective of market volatility. In the long run, we believe these characteristics will deliver outperformance for our clients.

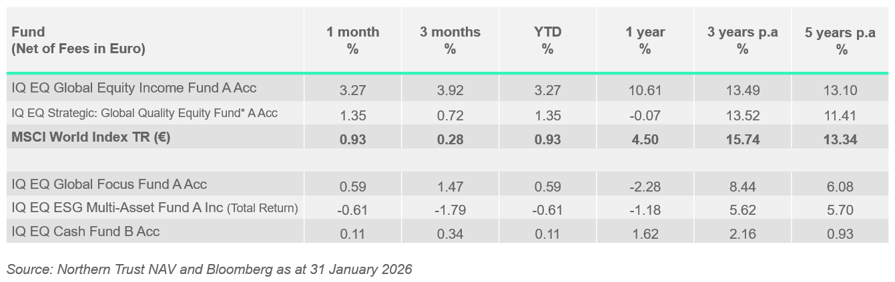

December 2025 figures for the IQ-EQ range of Funds:

IQ EQ Global Equity Income Fund: YTD 10.88% (Net of fees)

The IQ EQ Global Equity Income Fund returned 3.25% during the quarter, while the MSCI World Index rose by 3.2%. Stock Selection was a detractor from relative performance, while Currency and Sector Allocation were positive contributors during the period. Stock Selection was aided by strong performances from stocks such as Cummins and Merck, whilst within Asset Allocation the main drivers of outperformance were the underweight positions in Consumer Discretionary and Real Estate. The positive Foreign Currency effect was driven by an underweight position in the Japanese yen, which fell by ca.6% versus the euro during the quarter.

Key contributors during the period include:

+ Cummins Inc. (“CMI”) manufactures and sells a wide range of diesel, natural gas, and hybrid engines, power generators, and alternators. Its ability to improve the efficiency of its power solutions enables it to deliver double digit margins. Innovation is also positioning the company for the transition to electric powertrains. This has resulted in strong ESG credentials, highlighting its role as a leader in low emissions technologies. The Engine division has been relatively weak since US Environmental Protection Agency (EPA) announced earlier this year that it might row back on legislation tightening emissions, which is due to come into effect in 2027. The laws were expected to result in a strong market for trucks in the run-up to the introduction of the legislation. This is now at risk due to the EPA review. However, the company reported strong performance in its datacentre backup power business, which it gets from the deployment of AI-related services. Meanwhile, the company’s Accelera unit, which is focused on zero-emissions vehicles and technologies, is experiencing solid revenue growth and a strong backlog in its hydrogen technologies.

+ Taiwan Semiconductor Manufacturing Company (TSM) is a multinational semiconductor production and development company headquartered in Hsinchu, Taiwan. TSM manufactures semiconductors for corporations such as Apple, Nvidia, AMD and Qualcomm. The company has become the dominant microchip manufacturer due to its adoption of the “pure-play foundry” model, allowing it to focus on making chips that other companies design. The company has become the primary chip supplier to the “Magnificent 7”. After a pullback in November as investors took some profit on many of the AI-winners, the shares rallied into the year end, ending the year near all-time highs. Despite ongoing concerns about tariffs and American relations with China, the company has confirmed that its investment plans remain unchanged. The company has excellent sustainability credentials, operating with an exceptionally strong competitive moat, allowing them to put 70% of free cash flow into investors dividends each year.

- Fastenal Company (FAST) sells industrial and construction supplies products, such as fasteners, cutting tools, metal working, lifting, hardware, plumbing, lubricants, and other related products. FAST has strong sustainability credentials, reflecting its strong corporate governance with room to improve on green technology adoption. Despite a return to double-digit growth and a solid gross margin, the company's latest results lagged expectations as the company attempted to recover cost increases. Weaker pricing was also a feature for Q2 earnings earlier this year. Management is not raising prices at a faster rate than the cost increases if faces, preferring to maintain revenue growth rates instead. FAST continues to execute on its plan to close physical branches which should deliver cost savings as it better develops its digital strategy. The company will also benefit from any improvement in US industrial activity, which has been sluggish for several years.

- Nintendo develops, manufactures and sells video games hardware and software to a global market. The company has seen very strong demand for its Switch 2 device, which was launched in June 2025. Nintendo’s share price performed very strongly in the first three quarters of 2025 as the success of Switch 2 became apparent. In early November, the shares rallied towards an all-time high as management revealed that the company had sold over 10m copies of the Switch 2 console in the three months to end September 2025. However, a severe shortage of DRAM memory and associated components drove the price of DRAM up threefold in the fourth quarter. Demand is currently driven by activity in the AI industry. The vast quantities of memory required for AI in datacentres are displacing consumer-focused memory modules such as DRAM, thereby creating a shortage in the market. DRAM is a critical component in Nintendo’s console products and investors are concerned that, if current component prices are sustained, Nintendo’s unit shipments and margins may come under pressure. However, the company has indicated that it has sufficient stocks to meet demand in the near term.

IQ EQ Strategic: Global Quality Equity Fund*: YTD 0.62% (Net of fees)

The IQ EQ Strategic: Global Quality Equity Fund returned 2.29% during the quarter, underperforming the MSCI World Index, which rose by 3.2%. Stock Selection contributed negatively to relative performance, while Asset Allocation contributed positively and Currency Effects had negligible impact. The negative contribution from Stock Selection was due to the poor performance of held stocks such as Veeva Systems and REA Group. The strongest performer for the fund during the period was Alphabet Inc. The positive Asset Allocation outturn was driven primarily by sector overweight positioning in Health Care.

Key contributors during the period include:

+ Alphabet Inc. (“GOOGLE”) is composed of Google and a collection of subsidiaries through which it provides web-based search, advertisements, mapping, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products. The company had performed strongly in October after it released earnings that showed broad-based strength in revenues across all divisions. Growth in its Search business was an impressive 14.5%. Investors noted that the company ascribed the acceleration in search to the adoption of AI – a development that investors had seen as a potential threat to GOOGL as competitors, such as Microsoft, closed the gap in search. According to the company, AI is driving more search activity as users input more complicated searches confident in the knowledge that Google’s AI systems can produce accurate results. Alphabet followed that performance with strong reviews of its latest version of Gemini, the company’s AI model.

+ Eli Lilly & Co (LLY) develops and markets pharmaceuticals, focusing on four therapeutic areas: diabetes and obesity, oncology, immunology, and neuroscience. On the sustainability front, some quality assurance concerns are offset against peer-leading business ethics. Lilly reported strong 3Q25 earnings and the company raised full-year guidance signalling continuing momentum in demand for GLP-1s Zepbound & Mounjaro. The company is well positioned for upside in 2026 for two core reasons. First, the FDA submission for its new GLP-1 Orforglipron pill is due to be fast-track approved in Q1. Secondly, with US Medicare formally changing its stance on obesity as a covered condition, the number of potential customers for GLP-1 drugs is set to substantially increase.

- Microsoft Corporation (MSFT), is one of the world’s largest producers of enterprise and consumer software, continued to demonstrate resilience and innovation in 2025. On the sustainability front, the company supports initiatives in carbon, water, and waste management while corporate governance is rated as peer average. Q1 earnings were released in October. While strong, growth was a disappointment versus the market's elevated expectations. This was notable in the Azure cloud segment which was constrained by infrastructure supply. As a knock-on effect, company guidance for the forthcoming quarter was also tempered. Investors also worried about the significant AI-related capex and its potential for near-term returns. That said, MSFT continues to integrate AI across its tech stack, enhancing productivity tools like Microsoft 365 Copilot, Power BI, and Azure AI services.

- Veeva Systems Inc. (“VEEV”) provides cloud-based software catering to the health industry. The Company offers enterprise application, multichannel platform, customer relationship, and content management solutions. Veeva serves customers worldwide. The company holds an A rating from MSCI ESG, with peer-leading data security practices. At its second quarter results announcement in November, the company raised its guidance for Q3. Nevertheless, investors were disappointed with the performance of Vault CRM, its customer relationship management tool. Veeva said that the tool had been accepted by 14 of the 20 largest biopharma companies, which was fewer than investors had expected.

IQ EQ Global Focus Fund: YTD -1.46% (Net of fees)

The IQ EQ Global Focus Fund returned 3.70% during the quarter. The equity portfolio returned 5.6%%, while the bond portfolio returned 1.0%. Within the equity book, Alphabet and Roche were the best performers, while the biggest detractors from performance were ADP and Alegion. An underweight position in Consumer Discretionary and an overweight in Health Care contributed positively to Sector Selection within the equity book. The positive Foreign Currency effect was driven by an underweight position in the Japanese yen, which fell by ca.6% versus the euro during the quarter.

Key contributors during the period include:

+ Alphabet Inc. ("GOOGL") is composed of Google and a collection of subsidiaries through which it provides web-based search, advertisements, mapping, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products. The company performed strongly in Q4 after releasing earnings that showed broad-based strength in revenues across all divisions. Growth in its Search business was an impressive 14.5%. Investors noted that the company ascribed the acceleration in search to the adoption of AI – a development that investors had seen as a potential threat to GOOGL as competitors, such as Microsoft, closed the gap in search. According to the company, AI is driving more search activity as users input more complicated searches confident in the knowledge that Google’s AI systems can produce accurate results. Alphabet followed that performance with strong reviews of its latest version of Gemini, the company’s AI model.

+ Roche Holding AG (ROG) is one of the world’s largest pharmaceutical companies. Roche operates two divisions: Pharmaceuticals, which is 75% of revenues, and Diagnostics (25% of revenues). The company’s drugs address important therapeutic areas such as Cardiology and Oncology. Roche generates ca.50% of revenues from the lucrative US market; the balance is split evenly between Europe and Asia. Shares in ROG began to rally in October following a deal between Pfizer and the Trump administration, which alleviated concerns about the president’s plans for drug pricing in the US. The news lifted the global Health Care sector, which had been underperforming for the past three years. The news was followed by positive announcements from some important ongoing drug trials in relapsing multiple sclerosis (Fenebrutinib) and breast cancer (Giredestrant). The trial successes underpin revenue potential in the years ahead.

- Automatic Data Processing Inc (ADP) is a US provider of human resources management software and services, headquartered in Roseland, New Jersey. ADP is best known for its Payroll and Human Capital Management (HCM) products including ADP Workforce Now and ADP Global View Payroll. The company also provides many resources and services for smaller businesses using the ADP RUN solution. ADP’s performance is highly correlated with macroeconomic trends such as health of the labour market, interest rates, and unemployment. Its strategy involves extending its reach in the field of HR using its novel next-generation cloud platform. ADP released its revenue guidance for the fourth quarter in October. While these were in line with expectations, the company’s free flow cash margin declined to 11.5% from 15.8% last year. ADP’s sales guidance for 2025 is backed by employer services, with new bookings rising 4-7%, and midmarket share gains. This is expected to drive higher EBIT margins despite higher AI costs, which are being offset by price increases.

- Allegion (ALLE) is a security company focused on “security around door.” The company’s products include mechanical and electrical locks, access cards, door closers and exit devices. ALLE’s products service both the residential and commercial buildings. After a very strong performance in the first three quarters of 2025, ALLE detracted from performance in the fourth quarter. The company released third-quarter earnings towards the end of October which were better than analysts had expected. Earnings expectations for the full year 2025 and 2026 were duly raised. The North American non-residential market has been a particular driver of growth for the company in 2025. The company’s balance sheet also improved despite raising the dividend and buying back shares. Despite the positive earnings report, the company’s shares drifted lower into the end of the year.

IQ EQ ESG Multi-Asset Fund: YTD 1.85% (Total Return, net of fees).

Within the Equity Portfolio:

The IQ EQ Multi Asset Fund returned 1.34%, net of fees, during the fourth quarter. The equity component, which accounts for ca. 62% of the strategy, returned +2.85% gross. This compares to the MSCI World Index return of +3.17%. The relative performance of the equity book was driven by negative stock selection, while sector allocation and currency were accretive to relative returns. Stock selection was particularly weak within the information technology sector. Oracle and Microsoft were the primary driver of this underperformance. Alphabet and Merck were the best performers within the equity book during the quarter.

The positive contribution from sector allocation was driven by an overweight position in the Health Care sector, which outperformed during the quarter after underperformance on tariff fears and potential price curbs from the Trump administration. The overweight in Industrials was a minor negative contributor to sector allocation. The positive Foreign Currency effect was driven by an underweight position in the Japanese yen, which fell by ca.6% versus the euro during the quarter.

Key contributors during the period include:

+ Alphabet Inc. (“GOOGL”) is composed of Google and a collection of subsidiaries through which it provides web-based search, advertisements, mapping, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products. The company performed strongly in Q4 after releasing earnings that showed broad-based strength in revenues across all divisions. Growth in its Search business was an impressive 14.5%. Investors noted that the company ascribed the acceleration in search to the adoption of AI – a development that investors had seen as a potential threat to GOOGL as competitors, such as Microsoft, closed the gap in search. According to the company, AI is driving more search activity as users input more complicated searches confident in the knowledge that Google’s AI systems can produce accurate results. Alphabet followed that performance with strong reviews of its latest version of Gemini, the company’s AI model.

- Oracle Corp. (“Oracle”) supplies enterprises with hardware, software and services to run their businesses effectively. The company’s products include databases, applications, and cloud-based services. After much recent investment in cloud computing, this area now accounts for 85% of ORCL’s sales, while hardware is just 5%. In late-June the company issued its fiscal year 2025 annual results, which impressed investors. Moreover, the company issued forecast for strong growth in cloud and AI-related products and services. Looking ahead to fiscal year 2026, the company guided for revenue growth of 40% in cloud services, following on from 24% in fiscal 2025. This was followed up in August by an earnings report that forecast much higher-than-expected revenues from AI businesses, which sent the shares significantly higher. There is currently some scepticism about the company’s partnership with OpenAI and the funding requirement for the rollout of datacentres, which will be fitted out by Oracle and used by OpenAI. This, combined with profit taking, caused a fall in the shares in the fourth quarter, which erased the gains achieved in the third quarter.

Within the Bond Portfolio:

Performance

The bond portfolio was down 0.37% in the fourth quarter, outperforming its benchmark, the JP Morgan Global Bond Index (unhedged in euros), which declined by 0.46%. The main positive contribution to performance came from sector allocation (overweight positions in government agencies and corporate bonds) and security selection. While curve positioning in the Eurozone and UK detracted from performance, this was offset by curve positioning in the US and Australia.

Market

The JP Morgan Global Bond Index (unhedged in euros) declined by 0.46% in the fourth quarter. It was a period marked by an unusually wide dispersion of returns across major Developed Market sovereign bonds. UK Gilts and Japanese Government Bonds (JGB) stood at opposite ends of the return spectrum. UK Gilts delivered strong outperformance, as softer than expected inflation and employment data led markets to anticipate additional interest rate cuts from the Bank of England. In addition, investor sentiment was supported by a reasonably prudent budget and the UK Treasury’s decision to reduce long-dated issuance. In contrast, JGB’s came under pressure after newly appointed Prime Minister Sanae Takaichi announced a larger-than-expected economic stimulus package, which will require increased government borrowing and therefore issuance of JGB’s.

IQ EQ Cash Fund: YTD 1.67% (Net of fees)

The IQ EQ Cash Fund returned 0.35% during the fourth quarter, net of management fees, in euro terms.

The gross running yield on the Fund at end‑December was 1.79%, with the ECB continuing to monitor inflation, trade‑tariff risks, and European infrastructure spending. The Fund Management team maintained around 30% in short‑term liquidity and short‑dated government bonds, alongside deposits across maturities of up to one year.

The ECB held rates at 2% for a fourth meeting, with President Lagarde noting policy remains in a “good place”. She expects inflation to fall near term as energy effects fade, though risks remain two‑sided amid volatile global trade.

The Bank of England cut rates to 3.75%, signalling future decisions will be more finely balanced. ECB Governing Council Member de Galhau highlighted disinflation from a stronger euro and cheaper Chinese imports, while warning of upside risks from supply‑chain fragmentation and high German spending. German factory orders rose 1.5% in October, driven by an 87% jump in large transport‑sector orders.

Key contacts

If you have any queries please contact Timothy.Kelly@iqeq.com. or any member of our sales team at assetmanagement@iqeq.com. Additional information on the Davy Funds Plc range of funds can be found on our website here.

************************************************

WARNING: Past performance is not a reliable guide to future performance. The value of investments may fall as well as rise. Investments denominated in non-euro currencies, may be affected by changes in exchange rates when converted to euro or other currencies.

* Effective 1st May 2024 the IQ EQ Fund Management (Ireland) Limited managed sub-funds on the Davy Funds Plc umbrella were renamed removing “Davy” from the name and/or including “IQ EQ”. ( Davy Global Equity Income Fund to IQ EQ Equity Income Fund; Davy Strategic: Global Quality Equity Fund to IQ EQ Strategic: Global Quality Equity Fund; Davy Global Focus Fund to IQ EQ Global Focus Fund; Davy ESG Multi-Asset Fund to IQ EQ ESG Multi-Asset Fund, and Davy Cash Fund to IQ EQ Cash Fund). There has been no change to the investment objective or process.

IQ EQ Fund Management (Ireland) Limited is regulated by the Central Bank of Ireland. Details about the extent of our authorisation and regulation by the Central Bank of Ireland are available from us upon request.